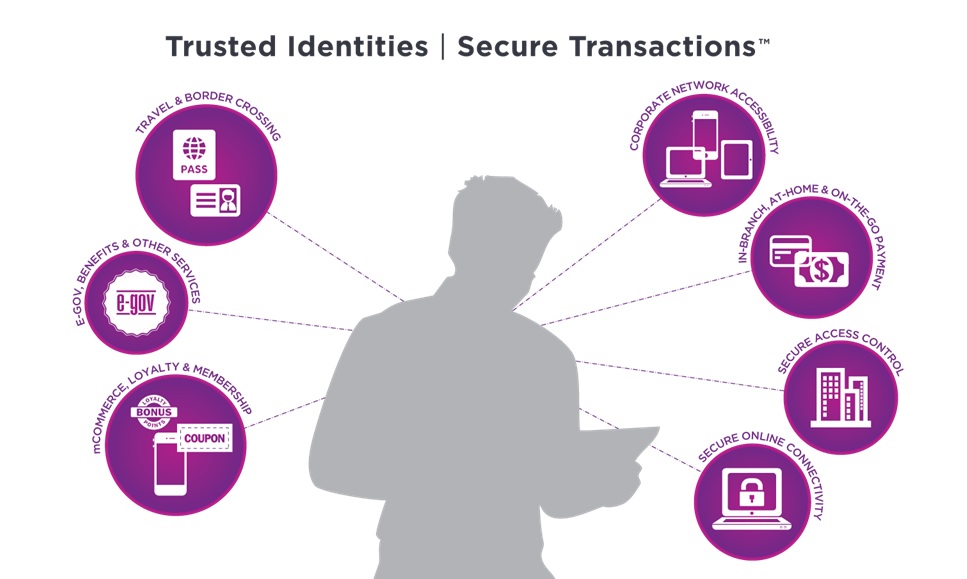

Consumers, citizens and employees increasingly expect anywhere-anytime experiences — whether they are making purchases, crossing borders, accessing e-gov services or logging onto corporate networks. Entrust offers the trusted identity and secure transaction technologies that make those experiences reliable and secure.

With our partner, Entrust, we offer strong authentication solutions with the capabilities, assurance levels, deployment options and mobile innovations you need to enable digital business – and protect what’s important to you.

We support the widest range of authenticators from hardware tokens to mobile push OTPs to align with your needs, and simplify your transaction from basic to high-assurance authentication. This breath of offering helps you adapt quickly to new technologies and evolving business processes.

Founded in 1969

2,000+ employees in 34 worldwide locations

Sales, service and support covering 150+ countries

10M+ identity and payment credentials issued daily

Billions of transactions managed annually

Transforming distribution and marketing with key capabilities in customer insight and analytics.

Acquiring and retaining digital banking consumers in today’s fiercely competitive marketplace requires a consumer-centric digital strategy. The key enabler for an effective digital strategy and strong mobile security is trusted identity. By utilizing a single trusted identity for mobile authentication, your digital banking customers can move freely between banking channels, access online services and mobile apps, and experience efficiencies at ATM, self-service and in-branch locations.

PSD2 Solution Brief “Although BANCO BICE initially wanted two-factor authentication to support mandated regulations, the financial institution quickly realized that they were able to enhance their customer experience by providing flexibility and ensuring a secure consumer experience.”